Losing your credit card or having it stolen can be a nightmare under any circumstances, but it can be particularly stressful when you’re in a foreign country. Being prepared for such an event can significantly minimize the damage and inconvenience. This article will guide you through the crucial steps to take if your credit card is lost or stolen abroad, covering everything from immediate actions to preventative measures you can take before your trip. Understanding how to handle this situation effectively can save you time, money, and unnecessary anxiety.

From contacting your bank and reporting the lost or stolen card to understanding your rights and responsibilities as a cardholder while traveling internationally, we’ll cover the essential information you need. We’ll also discuss crucial pre-trip planning to mitigate potential risks associated with credit card theft and loss, including informing your bank of your travel plans and exploring alternative payment methods. By following the advice provided in this article, you can navigate this challenging situation with greater confidence and minimize the impact on your trip abroad.

Act Immediately: Call Your Bank

The most critical first step after discovering your credit card is lost or stolen while abroad is to contact your bank immediately. Time is of the essence in these situations, as prompt action can minimize potential damage. Report the loss or theft to your bank’s customer service line. Have your credit card number ready, although you may still be able to report it even without the number. The bank will immediately deactivate your card, preventing unauthorized charges.

Confirm the last legitimate transactions you made. This helps the bank investigate any fraudulent activity and determine the extent of unauthorized use. Inquire about their procedures for issuing an emergency replacement card or providing access to emergency funds while you are abroad. Some banks can courier a replacement card to your location, while others may offer alternative solutions.

Keep a record of the date and time you contacted the bank, along with the name of the representative you spoke with. Obtain a reference number for your claim. This information will be essential for follow-up and any potential disputes.

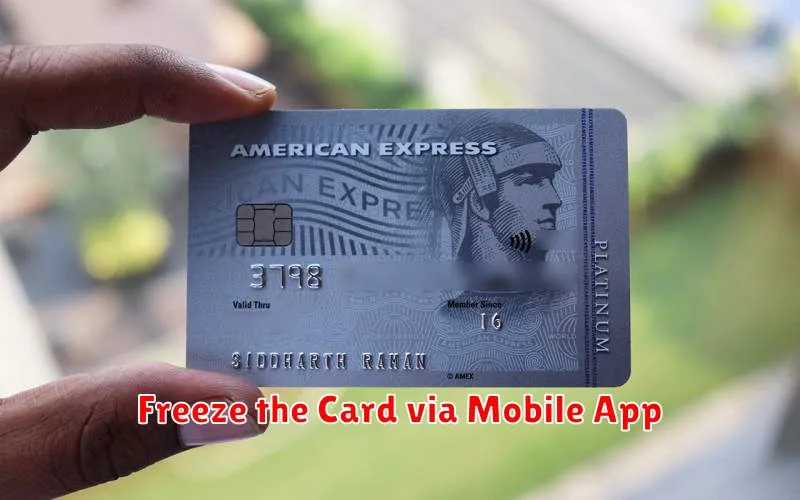

Freeze the Card via Mobile App

Many banks now offer mobile apps that allow you to immediately freeze your credit card. This action prevents new transactions from being processed without actually canceling your card. This is a crucial first step if you suspect your card is lost or stolen.

Freezing your card provides you with valuable time to search for it without the risk of fraudulent charges. If you locate the card, you can easily unfreeze it via the app and resume normal use.

Locate the “freeze card” feature within your bank’s app. The exact location and wording may vary, but it’s typically found in the card management or security settings section. Follow the prompts to confirm the freeze. You may receive a confirmation message via text or email.

If you’re unable to locate this feature or encounter difficulties, contact your bank’s customer service immediately for assistance.

Use Backup Cards or Emergency Cash

Losing your primary credit card can disrupt your travel plans significantly. This is why it’s crucial to have backup payment methods. Carrying a secondary credit card, preferably from a different issuer, is highly recommended. This prevents you from being entirely reliant on a single card. Store this backup card separately from your wallet or purse, perhaps in a secure pocket of your luggage or hotel safe.

In addition to a backup card, having access to emergency cash is essential. While credit cards are widely accepted, some smaller establishments or local vendors might prefer cash transactions. Having local currency on hand can prove invaluable in these situations. Consider pre-ordering currency from your bank before departure or withdrawing a reasonable amount upon arrival at your destination. Keep this cash secure and separate from your everyday spending money.

Keep Bank Contact Info in Your Phone

Before embarking on your trip, save the international contact information for your bank and credit card companies in your phone. This should include phone numbers and email addresses. Storing this information digitally ensures accessibility even if your physical wallet is lost or stolen.

Having these contact details readily available will allow you to quickly report any lost or stolen cards, minimizing potential damage. Prompt reporting is crucial for preventing fraudulent charges and initiating the card replacement process.

Consider creating a separate contact entry for each card, clearly labeling them with the card type and last four digits. This organization will expedite the reporting process when you need to contact the respective financial institution. You can also add important information like your credit card number and account number, keeping them in a secure and password-protected area in your phone.

File a Police Report if Necessary

Filing a police report is particularly important if your credit card was stolen, rather than simply lost. A police report provides official documentation of the theft, which can be helpful when disputing fraudulent charges with your credit card issuer and potentially with travel insurance providers. It also aids in tracking down the perpetrator and preventing further criminal activity.

Visit the nearest local police station to file a report. Be prepared to provide details such as your card number, the date and time you noticed it missing, and any suspicious activity you may have observed. Keep a copy of the police report for your records.

Remember, local law enforcement procedures vary. Be patient and cooperative throughout the process. Obtaining a police report may take time, so factor this into your travel plans.

While a police report isn’t always required for lost cards, it’s strongly recommended in cases of theft. This documentation can be crucial in protecting yourself from financial liability and facilitating the resolution process with your bank.

Follow Up for a Replacement Abroad

Once you’ve reported your lost or stolen card and requested a replacement, actively monitor your account for any unauthorized transactions. Even with a temporary hold, fraudulent activity can sometimes slip through. Regularly check your account online or via your bank’s mobile app.

Keep records of all communication with your bank and credit card company. This includes reference numbers, names of representatives you spoke with, and dates and times of calls or emails. This documentation will be essential if you need to dispute any fraudulent charges later.

Understand your card issuer’s policy on emergency card replacements. Some companies can courier a new card to you within 24-48 hours, even internationally. Others might offer a temporary virtual card number for immediate online use.

While waiting for your replacement card, consider alternative payment methods. Traveler’s checks, prepaid debit cards, or cash can be helpful backups. Inform your travel companions of the situation, so they can offer support if needed.

Document the Incident for Insurance Claims

Thoroughly documenting the incident is crucial for a successful insurance claim. Keep records of everything related to the loss or theft.

Immediately upon discovering your card missing, file a police report with local authorities. Obtain a copy of the report, as your insurance provider will likely require it. This report serves as official documentation of the incident. Note the date, time, location, and officer’s name.

Contact your credit card company and bank to report the lost or stolen card. Make a note of the date and time of your call, along with the representative’s name. Retain any email or written correspondence confirming the cancellation of your card and any subsequent actions.

Keep a record of any expenses incurred as a direct result of the card loss or theft. This may include transportation costs associated with obtaining a replacement card, phone calls to your bank or insurance company, or other reasonable expenses. Retain receipts for these expenses.