Traveling abroad is an enriching experience, but it can also be financially precarious if not managed carefully. Managing money safely while abroad is crucial for a stress-free trip. This article provides essential money management tips for travelers to avoid financial pitfalls and ensure a smooth journey. Learn how to budget effectively, choose the right payment methods, protect yourself from fraud, and handle currency exchange like a pro. Whether you’re backpacking through Southeast Asia or enjoying a luxurious European vacation, these tips will help you save money and stay financially secure while exploring the world.

Navigating foreign currencies and payment systems can be daunting, but with the right preparation, you can manage your finances abroad with confidence. This guide will cover a range of topics, from pre-trip financial planning to managing expenses on the go. We’ll explore the benefits and drawbacks of using credit cards, debit cards, and traveler’s checks, and offer advice on how to choose the best options for your specific needs. You’ll also discover practical tips for tracking your spending, avoiding hidden fees, and staying within your travel budget, allowing you to focus on enjoying your adventure to the fullest.

Plan Your Budget in Advance

Creating a comprehensive budget before your trip is a crucial step in managing your finances abroad. Start by researching the typical costs associated with your destination, including accommodation, food, transportation, activities, and visa fees. Factor in potential currency exchange rate fluctuations.

Organize your budget using a spreadsheet or budgeting app. Categorize your expenses and allocate a realistic amount for each. Consider using the 50/30/20 rule: 50% of your budget for needs, 30% for wants, and 20% for savings and debt repayment. Adapt these percentages based on your travel style and priorities.

Be sure to include a buffer for unexpected expenses, such as medical emergencies or travel delays. Having this extra cushion will provide financial security and peace of mind throughout your journey.

Use Multiple Payment Methods

Relying on a single payment method while traveling abroad can be risky. Diversify your payment options to mitigate potential problems. Losing your only credit card or having it compromised can leave you stranded.

Consider carrying a combination of credit cards, a debit card, and some local currency. Credit cards offer fraud protection and are widely accepted. A debit card provides direct access to your bank account funds. Keeping a small amount of local currency on hand is useful for smaller transactions, particularly in areas where card acceptance may be limited.

Before you depart, inform your bank and credit card companies of your travel dates and destinations. This helps prevent your cards from being flagged for suspicious activity. Familiarize yourself with the fees associated with using your cards abroad, such as foreign transaction fees and ATM withdrawal charges.

Keep Cash and Cards Separate

A fundamental safety precaution when traveling internationally involves separating your cash and cards. Losing your wallet or purse can be a significant setback, especially in an unfamiliar environment. By keeping your cash in one location and your cards in another, you mitigate the risk of losing all your financial resources at once. If one gets lost or stolen, you have a backup.

Consider dividing your cash further. Keep a small amount readily accessible for daily expenses in a secure pocket or pouch. Store the bulk of your cash separately, perhaps in your hotel room safe or a secure inner pocket of your luggage. This way, even if pickpocketed, you won’t lose everything.

Similarly, distribute your cards. Don’t carry all your credit and debit cards with you at all times. Leave some in your hotel safe. This practice limits potential losses if your wallet is compromised. Diversification is key to minimizing financial vulnerability while abroad.

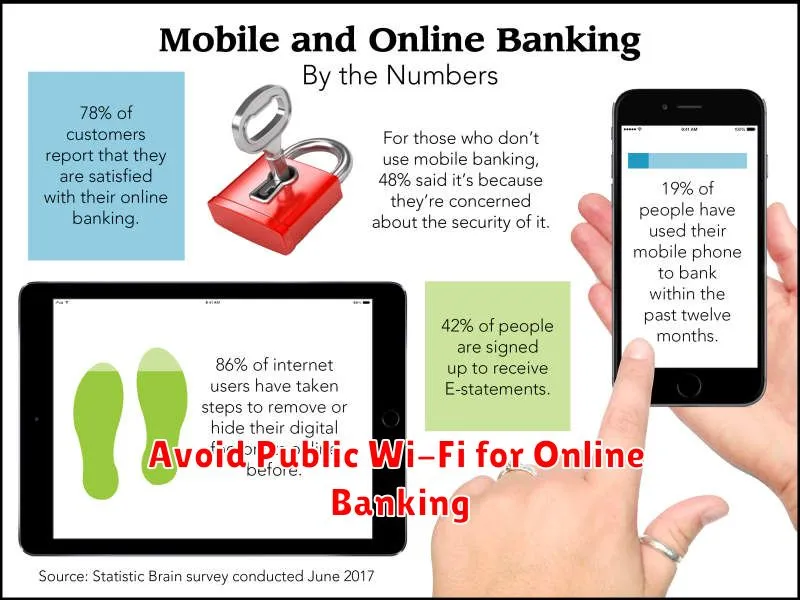

Avoid Public Wi-Fi for Online Banking

Public Wi-Fi hotspots are convenient, especially while traveling, but they pose a significant security risk for online banking. These networks are often unsecured, meaning your data is not encrypted and is vulnerable to interception by cybercriminals. Hackers can potentially gain access to your login credentials, account numbers, and other sensitive information.

Instead of public Wi-Fi, utilize a secure connection for managing your finances abroad. Consider using your mobile phone’s data connection as a safer alternative, especially if it’s a trusted network. Ensure your phone’s data usage is monitored to avoid excessive charges. If you must use Wi-Fi, opt for a password-protected network and verify its legitimacy with the establishment providing it, such as a hotel or reputable cafe.

Another safe option is to use a virtual private network (VPN). A VPN encrypts your internet traffic, making it much more difficult for hackers to intercept your data, even on public Wi-Fi. Choose a reputable VPN provider and ensure it’s active before conducting any online banking.

Notify Your Bank Before Departure

Before embarking on your international travels, it’s crucial to inform your bank and credit card companies of your trip. This simple step can prevent your cards from being flagged for suspicious activity and potentially blocked. Provide them with your travel dates and destinations.

Informing your bank allows them to monitor your account for any unusual transactions that might occur while you’re away. This proactive measure adds an extra layer of security to your finances. It also ensures that you can access your funds without interruption throughout your travels.

While notifying your bank, inquire about any foreign transaction fees they may charge. Understanding these fees can help you budget accordingly and avoid unexpected expenses. You might also consider asking about partner banks or ATMs at your destination to potentially minimize these charges.

Use ATMs Inside Banks or Airports

When withdrawing cash abroad, prioritize using ATMs located inside banks or airports. These locations generally offer increased security compared to standalone ATMs on the street. Bank-based ATMs are often monitored by security cameras and staff, deterring potential theft or tampering.

Airport ATMs, while sometimes charging higher fees, are typically situated in well-lit and secured areas, reducing the risk of fraudulent activities. Choosing these locations minimizes your exposure to skimming devices or other compromises that could lead to stolen card information.

Additionally, using ATMs inside banks allows you to quickly seek assistance from bank personnel should any issues arise during your transaction. This can be especially helpful if you encounter a malfunctioning machine or need clarification regarding fees. While airport ATMs may not offer direct staff assistance, the general security presence provides a greater degree of safety.

Monitor Accounts Regularly During Your Trip

Regularly monitoring your financial accounts is a critical aspect of safe money management while traveling abroad. This allows you to quickly identify any unauthorized transactions or discrepancies and take immediate action.

Utilize online banking or mobile banking apps to check your account balances and transaction history frequently, ideally daily. Set up transaction alerts to receive notifications for any activity, especially for withdrawals, payments, or large purchases.

Pay close attention to exchange rates and transaction fees. Keep a record of your spending to reconcile against your statements and help you stay within your budget. If you notice anything suspicious, contact your bank or financial institution immediately.